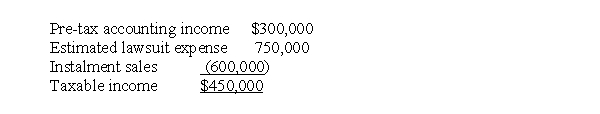

At the end of 2017, its first year of operations, Ontario Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The deferred tax liability to be recorded is

The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The deferred tax liability to be recorded is

Definitions:

Q1: R, a C corporation, has the

Q9: In the closing process, all the revenue

Q12: M and his wife are Kansas wheat

Q17: Which one of the following is not

Q31: One political factor influencing the standard setting

Q39: A taxpayer's at-risk amount increases only for

Q41: Compared to the accrual basis of accounting,

Q42: A company that follows ASPE<br>A)must not disclose

Q54: On January 1, 2017, Apricot Ltd.decided to

Q59: C had a long-term capital loss carryover