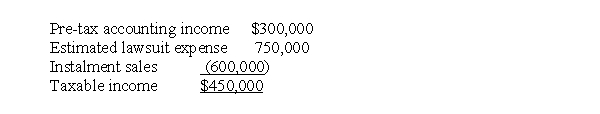

At the end of 2017, its first year of operations, Ontario Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The total income tax expense to be reported on the income statement is

The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The total income tax expense to be reported on the income statement is

Definitions:

Inventory Turnover

A ratio showing how many times a company's inventory is sold and replaced over a period, indicating the efficiency in managing stock levels.

Number of Days' Sales

A financial metric that measures how quickly a company can convert its inventory into sales.

Inventory Costing

The method used to assign costs to inventory and cost of goods sold, including techniques such as First-In First-Out (FIFO), Last-In Last-Out (LIFO), and weighted average cost.

Estimated Rate

An approximation used to calculate various financial metrics, often used when the exact value is unknown.

Q3: Financial accounting can be broadly defined as

Q6: One of the reasons the at-risk rules

Q10: A self-employed individual who establishes a qualified

Q15: Under IFRS, "other comprehensive income" does NOT

Q16: Country Corp.contracted to construct a building for

Q20: In a statement of cash flows, receipts

Q20: Y exchanges a rent house, which he

Q23: For the current year, a taxpayer had

Q39: Macintyre Inc. sells household furniture on an

Q50: Control of an asset normally coincides with<br>A)transfer