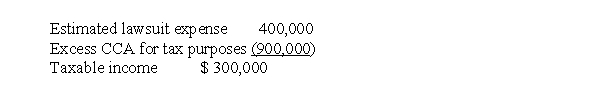

At the end of 2017, its first year of operations, Halifax Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Halifax adheres to IFRS requirements. The deferred tax liability to be recorded is

The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Halifax adheres to IFRS requirements. The deferred tax liability to be recorded is

Definitions:

Bruises

Marks on the skin resulting from blood leaking into the tissue, usually caused by trauma or injury.

Buttocks

The two rounded portions of the anatomy located on the posterior of the pelvic region.

Spanking

A form of discipline that involves striking the buttocks, often raising ethical and psychological concerns in child upbringing.

Document

A piece of written, printed, or electronic matter that provides information or evidence or that serves as an official record.

Q14: The financial statement which summarizes operating, investing,

Q18: In order for a corporation's stock to

Q21: R's personal sailboat is destroyed in a

Q37: Financial reporting is<br>A)independent of the environment in

Q38: The basis of the property must be

Q39: The holding period of like-kind property acquired

Q42: Which one of the following would not

Q44: Under a consignment sales arrangement, revenue is

Q44: Which of the following is likely to

Q73: A statement of cash flows prepared under