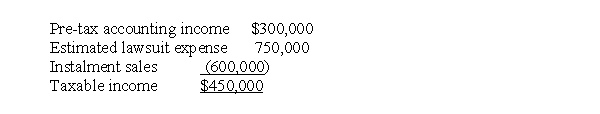

At the end of 2017, its first year of operations, Rinaldo Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The deferred tax asset to be recorded is

The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The deferred tax asset to be recorded is

Definitions:

Understand Emotions

The ability to recognize, interpret, and respond to the emotions of oneself and others.

Making Decisions

The cognitive process of choosing between different alternatives or options.

Barbara Fredrickson

A renowned psychologist known for her research on positive emotions and their role in human happiness and social connections.

Positive Emotions

Feelings that are generally pleasant and promote well-being, happiness, and fulfillment, such as joy, love, and satisfaction.

Q2: Ms.G obtained a 40 percent interest in

Q11: A and E are a married couple

Q11: On a statement of cash flows, the

Q17: Lump sum distributions out of an Individual

Q18: An external event involving a transfer or

Q19: Free cash flow is calculated as net

Q29: As part of the § 1231 netting

Q32: M Corporation has gross receipts of $800,000

Q37: N Airlines declared bankruptcy this year.As a

Q77: All of the following are disadvantages of