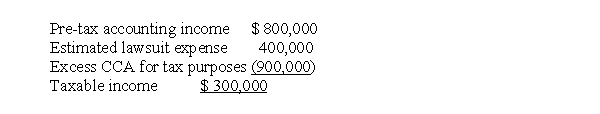

At the end of 2017, its first year of operations, Gaucho Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Gaucho adheres to IFRS requirements. The deferred tax asset to be recorded is

The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Gaucho adheres to IFRS requirements. The deferred tax asset to be recorded is

Definitions:

Specific Stock

Refers to the individual securities or shares issued by a company, representing ownership in that company.

Dow Jones

An American stock market index that shows how 30 large, publicly-owned companies based in the United States have traded during a standard trading session.

Price-Weighted Average

A stock index in which each company's influence on the index's performance is proportional to its stock price.

International Sales

Revenue generated from the sale of products or services outside of the company's home country.

Q6: K had short-term capital losses of $2,000

Q11: Losses that are not deductible due to

Q12: Management Discussion and Analysis (MD&A)does NOT include<br>A)notes

Q13: During the year, J sold his interest

Q17: Which of the following Code provisions or

Q19: The tax base of a liability is

Q22: D started a small business to make

Q34: In order for a retirement plan to

Q40: Using IFRS, IAS 12 guidelines allow for

Q59: A medical expense deduction is allowed for