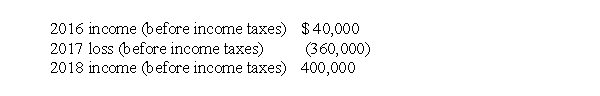

CB Properties Corporation reported the following results for its first three years of operations:  There were no permanent or reversible differences during these three years. Assume an income tax rate of 30% for 2016 and 2017, and 40% for 2018, and that any deferred tax asset recognized is more likely than not to be realized. If CB Properties elects to use the carryforward provisions and not the carryback provisions, what income (loss) is reported for 2017?

There were no permanent or reversible differences during these three years. Assume an income tax rate of 30% for 2016 and 2017, and 40% for 2018, and that any deferred tax asset recognized is more likely than not to be realized. If CB Properties elects to use the carryforward provisions and not the carryback provisions, what income (loss) is reported for 2017?

Definitions:

Body Physically

Pertains to the physical aspects and the functional capabilities of the body.

Hippocampus

A region of the brain associated with memory formation, learning, and emotions.

Long-Term Memory

The aspect of memory where information is stored for an extended period, ranging from hours to a lifetime.

Messages

In biological systems, messages refer to the information transmitted between cells or organisms, often in the form of chemical signals or nerve impulses.

Q4: Generally, a newly formed business expecting losses

Q7: Regarding treatment of cash and cash equivalents

Q18: In order for a corporation's stock to

Q19: H and W are married with three

Q32: Which of the following transactions is a

Q33: For the year ended December 31, 2017,

Q37: When D leaves home to go to

Q38: For calendar 2017, Melvin Corp. reported depreciation

Q43: The gain or loss on the disposition

Q68: Grant Limited pays all salaried employees on