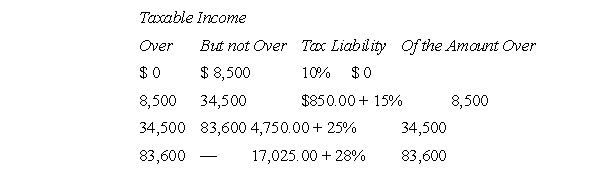

G is a single, calendar year, individual taxpayer.She has taxable income for the year 2011 of $65,000, including a net short-term capital gain of $5,000 and a net long-term (15 percent) capital gain of $10,000.The 2011 tax schedules for single taxpayers are as follows:  G's federal gross income tax for 2011 is

G's federal gross income tax for 2011 is

Definitions:

Paid Note Payable

The satisfaction or settlement of a debt instrument or promissory note through payment by the debtor to the lender according to the agreed terms.

Common Stock

Equity ownership in a corporation, with voting rights and the potential to receive dividends.

Treasury Stock

Shares that were issued and subsequently reacquired by the issuing company, reducing the amount of outstanding stock on the open market.

Stock Dividend

The payment of additional shares to shareholders instead of cash, usually at a fixed rate, often used by companies to conserve cash.

Q11: An apartment complex owned by H, a

Q12: During the current year, Q sold a

Q14: The form of organization usually used for

Q20: Taxpayer B is the president and sole

Q23: A covenant not to compete may be

Q40: Using IFRS, IAS 12 guidelines allow for

Q43: The "efficient markets hypothesis" proposes that<br>A)market prices

Q45: Which basic assumption may NOT be followed

Q45: Colossal Chocolate Company manufactures candy bars.Its gross

Q54: Taxable income of a corporation<br>A)differs from accounting