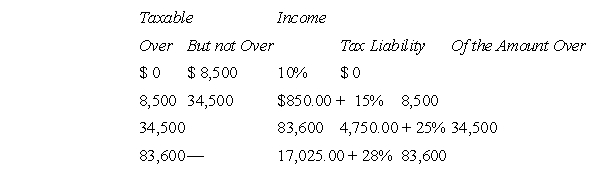

K is a single, calendar year, individual taxpayer.A net long-term (15 percent) capital gain of $10,000 is included in K's taxable income.The 2011 tax schedules for single taxpayers are as follows:  Which of the following is not true regarding the taxation of K's federal gross income tax for 2011?

Which of the following is not true regarding the taxation of K's federal gross income tax for 2011?

Definitions:

Recessive Genetic Disease

A disease caused by mutations in both copies of a gene pair in an individual; inheriting only one mutated gene typically results in being a carrier without showing disease symptoms.

Chromosomes 21

One of the 23 pairs of chromosomes in humans; an abnormality in the number of chromosome 21 leads to Down syndrome.

Genetic Disorder

A disease or condition caused by an abnormality in an individual's DNA, ranging from small mutations to large chromosomal changes.

Codominance

A genetic scenario where two alleles of a gene pair in a heterozygote are fully expressed, resulting in offspring with a phenotype that is neither dominant nor recessive.

Q1: There is no difference between a tax

Q21: Financial or capital market risks are related

Q21: If straight-line depreciation is used by an

Q23: On Sesame's multiple-step income statement for 2017,

Q27: The de minimis amount of discount for

Q29: Taxpayers are not permitted to adopt LIFO

Q37: Management accounting can be broadly defined as

Q37: N Airlines declared bankruptcy this year.As a

Q49: Which one of the following is true

Q77: An annuity has an annual compound interest