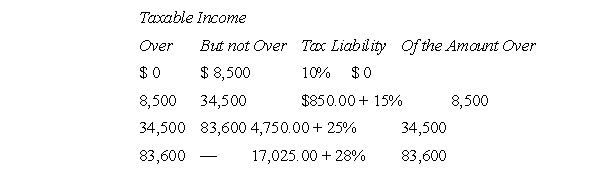

G is a single, calendar year, individual taxpayer.She has taxable income for the year 2011 of $65,000, including a net short-term capital gain of $5,000 and a net long-term (15 percent) capital gain of $10,000.The 2011 tax schedules for single taxpayers are as follows:  G's federal gross income tax for 2011 is

G's federal gross income tax for 2011 is

Definitions:

Protecting Family

The act or process of ensuring the safety, well-being, and financial security of family members.

Police-Reported Crime

refers to incidents of crime that have been formally reported to and recorded by the police.

Violent Crime

A category of crime involving force or the threat of force against a person, including offenses such as murder, rape, and robbery.

Traditional Nuclear Family

A family structure consisting of two parents (usually a married couple) living with their biological or adopted children.

Q2: BobCo incurred $60,000 of qualifying research

Q10: For a capital gain or loss to

Q10: On November 1, 2017, Green Corp.purchased equipment

Q20: Under IFRS, which of the following is

Q28: B, a sole proprietorship, has the

Q33: S is employed by Clips, a large

Q34: N purchased a camera for use in

Q35: J and K decided they wanted to

Q47: Preparation of consolidated financial statements when a

Q59: A medical expense deduction is allowed for