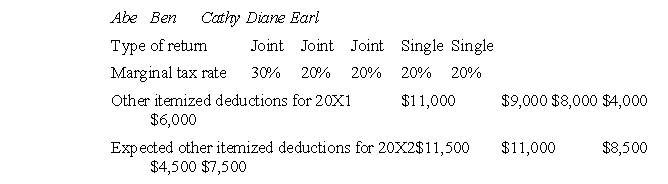

Each of the following individual taxpayers is planning on making a deductible $500 payment (e.g., a fully deductible charitable contribution) either in December 20X1 or in January 20X2.Assume the standard deduction for both years for joint filers is $10,000 and for single filers is $4,000.Ignore the time value of money.  Assuming that between years there are no changes in tax rates and other items (e.g., standard deduction, personal exemption, etc.) and ignoring the time value of money, who would gain the greatest tax savings by making the payment in 20X2 instead of 20X1?

Assuming that between years there are no changes in tax rates and other items (e.g., standard deduction, personal exemption, etc.) and ignoring the time value of money, who would gain the greatest tax savings by making the payment in 20X2 instead of 20X1?

Definitions:

Purchase Returns

Goods returned by the buyer to the supplier due to defects, inaccuracies in shipment, or other discrepancies.

Allowances

A deduction from the gross amount on an invoice by the buyer for goods purchased or to cover some type of shortcoming.

Purchase Discounts

Reductions in the price of goods or services allowed by the seller for early payment by the buyer.

Contra Expense Accounts

Accounts that are used to offset or reduce expense accounts on the income statement, resulting in the net amount of expense being reported.

Q9: T's itemized deductions for the current year

Q10: Based on the above information, what is

Q36: At a business lunch to entertain a

Q40: Congress has chosen to exclude many sources

Q42: Both FICA and FUTA impose a double

Q45: The DAB Corp. has unfortunately accumulated net

Q53: Which of the following actions would likely

Q60: A taxpayer who does not file a

Q69: Items that generally may be excluded by

Q81: Cash is often referred to as a