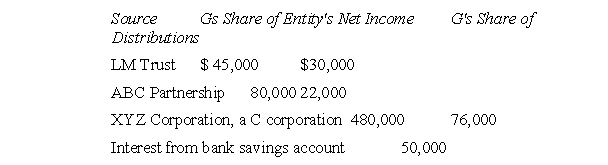

G is an 11-year-old heiress whose share of income from various sources is as follows for the current year:  G's A.G.I, (ignoring the deduction for one-half of any self-employment tax, if any) is how much?

G's A.G.I, (ignoring the deduction for one-half of any self-employment tax, if any) is how much?

Definitions:

Provincial Partnership Acts

Statutes enacted by provincial governments in Canada that govern the formation, operation, and dissolution of partnerships.

Unlimited Liability

A legal structure where business owners are personally responsible for all of the business's debts, without limitation to their personal assets.

Partnership Assets

Assets owned by a partnership, which are used in the operation of the business and are subject to the rights and interests of the partners.

Debts

Money that is owed or due to another individual or entity.

Q7: Mr.and Mrs.K purchased their current residence in

Q8: Simonyan Inc. forecasts a free cash flow

Q11: T was looking for a house when

Q11: If the constant growth model is used

Q15: The keeping of records required for listed

Q17: Which of the following cannot create a

Q24: Which of the following statements is true

Q26: Taxpayers who adopt LIFO during periods of

Q28: If a company announces a change in

Q33: Which of the following is not an