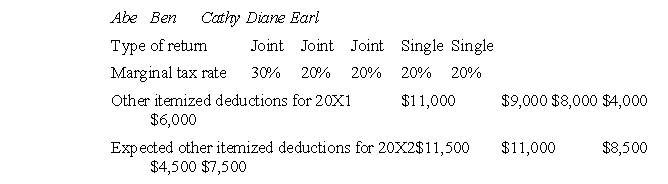

Each of the following individual taxpayers is planning on making a deductible $500 payment (e.g., a fully deductible charitable contribution) either in December 20X1 or in January 20X2.Assume the standard deduction for both years for joint filers is $10,000 and for single filers is $4,000.Ignore the time value of money.  Assuming that between years there are no changes in tax rates and other items (e.g., standard deduction, personal exemption, etc.) and ignoring the time value of money, who would gain the greatest tax savings by making the payment in 20X2 instead of 20X1?

Assuming that between years there are no changes in tax rates and other items (e.g., standard deduction, personal exemption, etc.) and ignoring the time value of money, who would gain the greatest tax savings by making the payment in 20X2 instead of 20X1?

Definitions:

Pocket Veto

A legislative maneuver available to the U.S. President to indirectly veto a bill by retaining it unsigned until it is too late for it to be dealt with during the legislative session.

Congressional

Pertaining to or characteristic of a formal legislative body that governs a nation, particularly in relation to the United States Congress.

Patronage

The support, encouragement, privilege, or financial aid that an organization or individual bestows to another; in politics, often refers to the appointment of individuals to government positions based on their support of a party or candidate rather than on their qualifications.

Civil Service

A body of employees in the public sector employed by governmental departments and agencies, excluding armed forces and political appointments.

Q5: Taxpayers may deduct the cost of a

Q6: R, a museum director, timed a business

Q12: Zhdanov Inc. forecasts that its free cash

Q14: A taxpayer is allowed to change the

Q18: Which statement is not true of straight-line

Q18: C obtained a new job in

Q34: R backed into his neighbor's mailbox, destroying

Q43: A product sells for $750 in Canada.

Q101: Long-term loan agreements always contain provisions, or

Q108: What would be the cost to BC