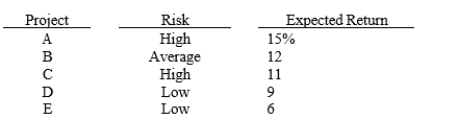

Langston Labs has an overall (composite) WACC of 10%, which reflects the cost of capital for its average asset. Its assets vary widely in risk, and Langston evaluates low-risk projects with a WACC of 8%, average projects at 10%, and high-risk projects at 12%. The company is considering the following projects:  Which set of projects would maximize shareholder wealth?

Which set of projects would maximize shareholder wealth?

Definitions:

Curvilinear Relationships

Relationships between two variables where the strength and/or direction of the association changes over the range of the variable's value, forming a curve rather than a straight line.

Confounds

Variables that could potentially contaminate or influence the outcome of an experiment, making it hard to interpret the effects of the primary variables of interest.

Factorial Design

An experimental strategy in which factors are varied together to examine their interaction effects on a response variable.

Independent Variables

Variables that are manipulated or changed in an experiment to test their effects on dependent variables.

Q10: As a firm approaches bankruptcy, the indirect

Q21: If a firm utilizes debt financing, an

Q30: Pavlin Corp.'s projected capital budget is $2,000,000,

Q40: Which of the following statements about dividend

Q50: Most studies of stock market efficiency suggest

Q52: Which of the following statements is correct?<br>A)

Q55: Schnusenberg Corporation just paid a dividend of

Q59: Which of the following statements is correct?<br>A)

Q64: Which of the following statements is correct?<br>A)

Q80: Which of the following statements best describes