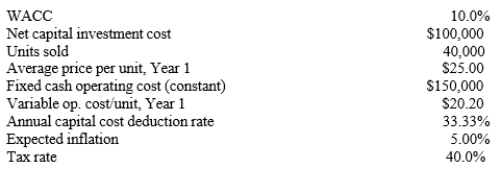

Dumpe Industries is analyzing an average-risk project, and the following data have been developed. Unit sales will be constant, but the sales price will increase with inflation. Fixed costs will also be constant, but variable costs will rise with inflation. The project should last for 3 years, and there will be no salvage value. This is just one project for the firm, so any losses can be used to offset gains on other firm projects. What is the project's expected NPV? (Note: the constant annual capital cost deduction rate facilitates the calculations.)

Definitions:

Christianity

A monotheistic religion based on the life and teachings of Jesus Christ, emphasizing salvation through faith and the importance of love and forgiveness.

Iroquois Confederacy

The Iroquois Confederacy, also known as the Haudenosaunee or Six Nations, was a powerful and sophisticated alliance of native tribes in northeastern North America, known for its significant cultural and governmental contributions.

Glorious Revolution

A coup in 1688 engineered by a small group of aristocrats that led to William of Orange taking the British throne in place of James II.

Slave Trade

The historical trading of enslaved people, primarily from Africa to the Americas, which was a crucial part of the global economic system from the 16th to the 19th century.

Q11: The optimal distribution policy strikes a balance

Q11: Assuming that their NPVs based on the

Q12: The higher the firm's flotation cost for

Q28: Floating-rate debt is advantageous to investors because

Q29: Xerox and IBM are good examples of

Q49: Although they operate in different industries, two

Q57: Prock Petroleum's stock has a required return

Q62: Reynolds Resorts is currently 100% equity financed.

Q96: Returns for the Shields Company over the

Q101: Which of the following statements best describes