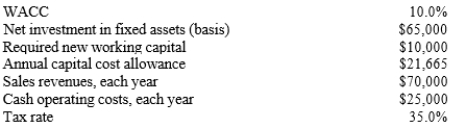

Party Place is considering a new investment whose data are shown below. The equipment that would be used would have a constant annual capital cost allowance over the project's 3-year life and a zero salvage value. This project would require some additional working capital that would be recovered at the end of the project's life. Revenues and cash operating costs are expected to be constant over the project's 3-year life. What is the project's NPV? (Hint: Cash flows are constant in Years 1 to 3. CCA is modified to smooth out the calculations.)

Definitions:

Financing Costs

Financing costs are expenses incurred by an entity in the process of borrowing funds, including interest payments and other related fees.

Market Value

The ongoing trading value of an asset or service in the market.

Preferred Stock

A type of stock that provides holders with a fixed dividend prior to any dividend payments to common stockholders, and typically does not carry voting rights.

Common Stock

A form of corporate equity ownership, representing a share in the ownership of a company and a claim on a portion of its profits.

Q3: Rainier Bros. has 12.0% semiannual coupon bonds

Q5: Shahrokhi Enterprises follows a moderate current asset

Q27: A synthetic lease is a combination of

Q33: If a stock's dividend is expected to

Q38: The slope of the SML is determined

Q55: Which of the following statements is correct?<br>A)

Q69: If an investment project would make use

Q71: Scanlon Inc. is considering Projects S and

Q105: If a project's NPV exceeds its IRR,

Q109: A stock's beta is more relevant as