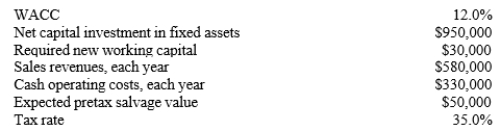

Majestic Theaters is considering investing in some new projection equipment whose data are shown below. The required equipment has a 7-year project life falling into a CCA class of 30%, but it would have a positive pre-tax salvage value at the end of Year 7. Also, some new working capital would be required, but it would be recovered at the end of the project's life. Revenues and cash operating costs are expected to be constant over the project's 7-year life. What is the project's NPV?

Definitions:

Emotional Conquest

The process of winning over or gaining control through emotional influence or appeal.

Golden Personality Type

A term that might refer to an ideal or highly regarded personality classification in certain personality assessment frameworks, though not a standard term in psychology.

Learning Style

The idea that different people learn best in different ways.

Human Development

A multidisciplinary approach studying human growth, development, and potential across the lifespan, incorporating aspects of physical, emotional, and intellectual changes.

Q6: Hettenhouse Company's perpetual preferred stock sells for

Q9: Opportunity costs include those cash inflows that

Q41: Which of the following actions will best

Q42: If a typical company uses the same

Q45: The graphical probability distribution of ROE for

Q50: What is the bond's conversion ratio?<br>A) 27.14<br>B)

Q58: Toombs Media Corp. recently completed a 3-for-1

Q62: Reynolds Resorts is currently 100% equity financed.

Q65: Which of the following statements is correct?<br>A)

Q94: Bello Corp. has annual sales of $50,735,000,