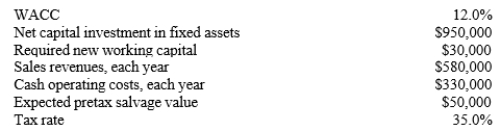

Majestic Theaters is considering investing in some new projection equipment whose data are shown below. The required equipment has a 7-year project life falling into a CCA class of 30%, but it would have a positive pre-tax salvage value at the end of Year 7. Also, some new working capital would be required, but it would be recovered at the end of the project's life. Revenues and cash operating costs are expected to be constant over the project's 7-year life. What is the project's NPV?

Definitions:

Cash Flow Hedge

A cash flow hedge is a type of hedge that is used to manage exposure to variability in cash flows, particularly those related to forecasted transactions that could affect profit or loss.

Option Expense

The cost associated with granting stock options to employees or executives, which companies must expense in their financial statements.

Fair Value Hedge

A hedging strategy aimed at protecting against the risk of changes in the fair value of an asset, liability, or an identified portion of such, that is attributable to a particular risk.

Foreign Exchange Risk

The potential for loss due to fluctuations in currency exchange rates affecting the value of foreign-denominated transactions and investments.

Q2: The ABC Bank enters into a credit

Q3: Which of the following statements is correct?<br>A)

Q27: The Miller model begins with the MM

Q28: Suppose Tapley Corporation uses a WACC of

Q31: You have the following data: D1 =

Q46: Bey Bikes is considering a project that

Q65: Which of the following is likely to

Q73: An increase in the holding of marketable

Q75: Which of the following would increase the

Q87: Stock X has a beta of 0.6,