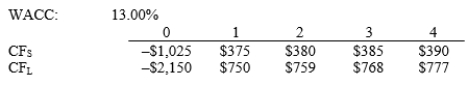

A firm is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO wants to use the IRR criterion, while the CFO favours the NPV method, and you were hired to advise the firm on the best procedure. If the CEO's preferred criterion is used, how much value will the firm lose as a result of this decision?

Definitions:

Corrosion

The process of deterioration and consumption of a material through a chemical reaction with its environment, often leading to weakening or destruction of the material.

Concentrated Lye

A highly caustic solution, often sodium hydroxide, used for cleaning, unblocking drains, and making soap.

Accidental Spillage

Unintended release or leak of substances, which could be hazardous or non-hazardous, due to mishandling or accidents.

First-listed Diagnosis

The primary medical condition diagnosed during a healthcare visit, determining the primary reason for the encounter.

Q11: Assume that a piece of leased equipment

Q19: Consider the following information about an IPO.

Q35: The trade-off theory states that the capital

Q36: The TSX Exchange operates as a junior

Q40: You were hired as a consultant to

Q42: If a typical company uses the same

Q46: P&D Co. has a capital budget of

Q48: In many loan securitizations, most borrowers of

Q69: D. J. Masson Inc. recently issued noncallable

Q79: Which of the following statements is correct?<br>A)