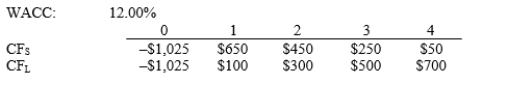

Moerdyk & Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV, i.e., no conflict will exist.

Definitions:

Wrinkles

Lines or creases in the skin, often resulting from aging, repeated facial expressions, or environmental factors.

Epidermis

The outermost layer of skin that provides a waterproof barrier and creates our skin tone.

Psoriasis

A chronic skin condition characterized by red patches covered with silver-white scales.

Protein Substance

A type of biological molecule composed of one or more chains of amino acids, critical for the structure, function, and regulation of the body's tissues and organs.

Q15: Stock dividends and stock splits should, at

Q22: Which of the following statements best describes

Q25: Standard deviation is a measure of market

Q26: A proxy is a document giving one

Q27: The Bank of Canada is the primary

Q33: Underlying the dividend irrelevance theory proposed by

Q39: As a member of Midwest Corporation's financial

Q42: The Isberg Company just paid a dividend

Q72: Stock A has an expected return of

Q91: Project X's IRR is 19% and Project