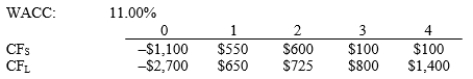

Pappas Products is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the MIRR. If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR, how much, if any, value will be forgone? Note that under some conditions the choice will have no effect on the value gained or lost.

Definitions:

Long-Term Debt

Borrowings that are due to be repaid more than one year from the date of the financial statement.

Dividend Payout

A portion of a company's earnings that is distributed to shareholders.

External Financing Needed

The additional funding a firm requires to finance its spending plans, such as investments in fixed assets or increases in working capital, beyond what can be funded by internal sources.

Dividend Payout Ratio

A metric indicating the proportion of a company's net profits paid out to its shareholders as dividends.

Q12: In a synthetic lease a special purpose

Q13: Projects S and L both have an

Q27: Last year Handorf-Zhu Inc. had $850 million

Q36: A lease versus purchase analysis should compare

Q40: An increase in the debt ratio will

Q46: Bey Bikes is considering a project that

Q65: A decrease in the firm's discount rate

Q68: What does the yield-to-maturity on bonds refer

Q74: Thompson Stores is considering a project that

Q79: A firm is considering Projects S and