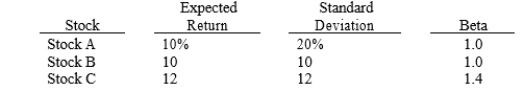

Consider the following information for three stocks, A, B, and C, and portfolios of these stocks. The stocks' returns are positively but not perfectly positively correlated with one another, i.e., the correlation coefficients are all between 0 and 1.  Portfolio AB has half of its funds invested in Stock A and half in Stock B. Portfolio ABC has one third of its funds invested in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns. Which of the following statements is correct?

Portfolio AB has half of its funds invested in Stock A and half in Stock B. Portfolio ABC has one third of its funds invested in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns. Which of the following statements is correct?

Definitions:

Millennials

A generational cohort following Generation X, typically described as those born from the early 1980s to the late 1990s.

Transformational Leadership

A leadership style that inspires and motivates followers to achieve extraordinary outcomes by transforming their beliefs and values.

Psychological Gains

Benefits or improvements in mental health, well-being, or emotional state as a result of specific actions, experiences, or therapeutic interventions.

Laissez-Faire Leader

A leadership style characterized by minimal supervision, where followers are given a high degree of freedom in their decision-making processes.

Q3: Which of the following statements is correct?<br>A)

Q14: Choi Computer Systems is considering a project

Q18: A common share just paid a dividend

Q22: Which of the following is true regarding

Q40: You were hired as a consultant to

Q42: Stock X has a beta of 0.7

Q59: Chambliss Inc. hired you as a consultant

Q94: Stock X has a beta of 0.5

Q98: Which of the following statements is correct?<br>A)

Q110: Variance is a measure of the variability