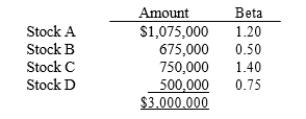

Assume that you are the portfolio manager of the Coastal Fund, a $3 million hedge fund that contains the following stocks. The required rate of return on the market is 14.00% and the risk-free rate is 6.00%. What rate of return should investors expect (and require) on this fund?

Definitions:

Standard Errors

A measure of the statistical accuracy of an estimate, calculated from the standard deviation of the sampling distribution.

Sample Mean

This is the average of all the values in a sample set, calculated by summing all the numbers in the sample and then dividing by the count of the sample.

Control Limits

Predetermined boundaries in statistical process control charts that signal when a process might be out of control, based on the process's historical data.

Standard Errors

Standard errors quantify the variability or uncertainty in a statistic, such as the mean, estimated from a sample when it is used to estimate the true population parameter.

Q6: Last year Godinho Corp. had $250 million

Q8: Which of the following statements is correct?<br>A)

Q14: Stock A's beta is 1.5 and Stock

Q24: Which of the following statements is correct?<br>A)

Q39: Beranek Corp. has $410,000 of assets, and

Q46: If an investor buys enough stocks, he

Q72: In Canada, amortization is a similar concept

Q73: If the expected rate of return for

Q74: The Zumwalt Company is expected to pay

Q92: Junk bonds are high-risk, high-yield debt instruments.