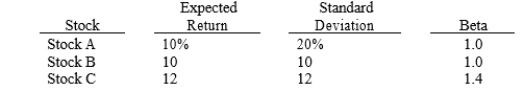

Consider the following information for three stocks, A, B, and C, and portfolios of these stocks. The stocks' returns are positively but not perfectly positively correlated with one another, i.e., the correlation coefficients are all between 0 and 1.  Portfolio AB has half of its funds invested in Stock A and half in Stock B. Portfolio ABC has one third of its funds invested in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns. Which of the following statements is correct?

Portfolio AB has half of its funds invested in Stock A and half in Stock B. Portfolio ABC has one third of its funds invested in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns. Which of the following statements is correct?

Definitions:

Nucleus

The central and most important part of an object, movement, or group, forming the basis for its activity and growth, or in biology, the membrane-bound organelle in a cell that contains DNA.

Soma

In biological terms, it refers to the body of an organism as distinct from its reproductive cells, or in cellular anatomy, the cell body of a neuron.

Neuron

A specialized cell that conducts impulses through the nervous system.

Dendrite

The branched projections of a neuron that act to conduct the electrochemical stimulation received from other neural cells to the body, or soma, of the neuron from which it projects.

Q13: You were hired as a consultant to

Q15: Which of the following statements best describes

Q18: MM shows that in a world with

Q35: Which of the following statements regarding a

Q38: Which of the following statements is correct?

Q39: Which of the following statements is correct?<br>A)

Q40: Your uncle has $300,000 invested at 7.5%,

Q54: The existence of dual-class shares allows a

Q59: The IRR of normal Project X is

Q82: Your portfolio consists of $50,000 invested in