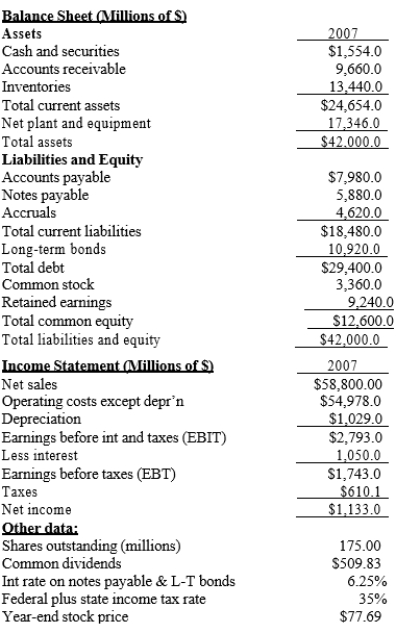

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-What is the firm's profit margin?

Definitions:

Book Depreciation

The depreciation of an asset recorded in the financial statements of a business, calculated using the chosen depreciation method.

Tax Rate

The percentage at which an individual or corporation is taxed, which can vary depending on income level, type of tax, or jurisdiction.

Deferred Tax

A tax obligation that a company owes in the future due to timing differences between its taxable income and its accounting earnings.

Accrued Expenses

Expenses that have been incurred but not yet paid or recorded, representing liabilities for services or goods received.

Q1: Which of the following statements best describes

Q1: Last year, Michelson Manufacturing reported $10,250 of

Q16: Which of the following statements best describes

Q27: Which of the following statements best describes

Q31: Other things held constant, which of the

Q35: Which of the following statements regarding a

Q59: Which of the following statements best describes

Q64: "Risk aversion" implies that investors require higher

Q94: Stock X has a beta of 0.5

Q102: What is the firm's total assets turnover?<br>A)