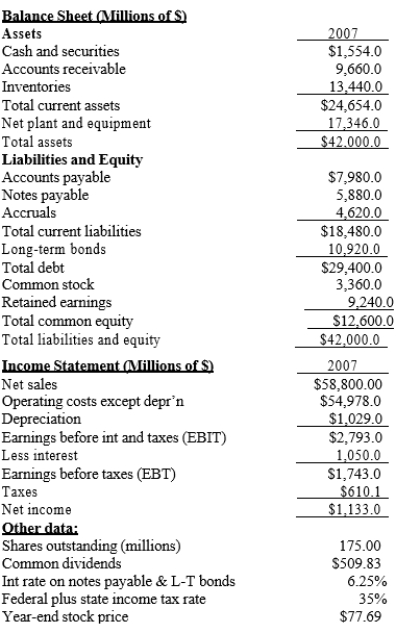

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-What is the firm's dividends per share?

Definitions:

Effective Interest Rate Method

The method of amortizing discounts and premiums that provides for a constant rate of interest on the carrying amount of the bonds at the beginning of each period; often called simply the “interest method.”

Constant Dollar

A term used in economics to describe a monetary value that has been adjusted for inflation, thereby facilitating comparison of purchasing power over different periods.

Interest Expense

The cost incurred by an entity for borrowed funds, often reported on the income statement as a non-operating expense.

Unamortized Premium

The portion of the bond premium that has not yet been amortized (expensed) over the life of the bond.

Q4: CFA is a professional designation for individuals

Q10: Rates of return reported by mutual funds<br>A)

Q24: A loading fee charged by a mutual

Q30: Last year Tiemann Technologies reported $10,500 of

Q37: A 10-year corporate bond has an annual

Q44: As a result of arbitrage, ETFs tend

Q52: Quigley Inc. is considering two financial plans

Q56: A high beta coefficient for a mutual

Q67: A firm wants to strengthen its financial

Q79: If the CEO of a large, diversified