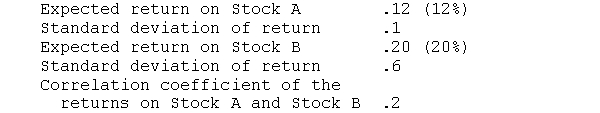

Given the following information:  a. What are the expected returns and standard deviations of the following portfolios:1. 100 percent of funds invested in Stock A 2. 100 percent of funds invested in Stock B 3. 50 percent of funds invested in each stock b. What would be the impact if the correlation coefficient were 0.6 instead of 0.2

a. What are the expected returns and standard deviations of the following portfolios:1. 100 percent of funds invested in Stock A 2. 100 percent of funds invested in Stock B 3. 50 percent of funds invested in each stock b. What would be the impact if the correlation coefficient were 0.6 instead of 0.2

Definitions:

EBIT

Earnings Before Interest and Taxes; a measure of a firm's profit that includes all expenses except interest and income tax expenses.

Interest Expense

Over a span of time, the monetary burden borne by an entity due to borrowed capital.

Earning Per Share

A company's net profit divided by the number of its outstanding shares, indicating the profitability on a per-share basis.

Total Equity

The sum of all stakes in a corporation, determined by subtracting total liabilities from total assets.

Q3: Which of the following is not used

Q6: Investing in stocks purchased by insiders may

Q12: You are negotiating to make a 7-year

Q13: A bond that is traded "flat" has

Q14: If an investor believes that financial markets

Q19: An index fund limits its portfolio to<br>A)

Q23: The market consists of the following stocks.

Q27: If the underwriter overprices a new issue,

Q27: What is the firm's EBITDA coverage?<br>A) 3.29<br>B)

Q91: A decline in a firm's inventory turnover