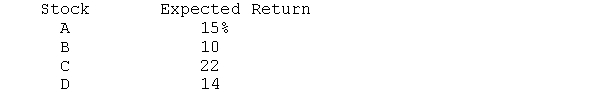

What is the expected return on a portfolio consisting of an equal amount invested in each stock  b. What is the expected return on the portfolio if 50 percent of the funds are invested in stock C, 30 percent in stock A, and 20 percent in Stock D

b. What is the expected return on the portfolio if 50 percent of the funds are invested in stock C, 30 percent in stock A, and 20 percent in Stock D

Definitions:

Cost of Capital

The rate of return that a company must earn on its investment projects to maintain its market value and attract funds.

Implicit Costs

The opportunity costs incurred by a firm for using its own resources without a direct monetary payment.

Implicit Costs

Costs that represent the loss of potential income from resources when they are not utilized in their best alternative use.

Opportunity Cost

Forgoing possible gains from various alternatives by picking a specific one.

Q7: Which is the smallest if the interest

Q17: Compounding refers to the earning of interest

Q19: If the country's exports increase, GDP declines.

Q22: A global fund invests solely in foreign

Q26: A mortgage trust is a REIT that

Q26: The procedure for the distribution of dividendsdoes

Q51: The portfolio manager of a value fund

Q53: A market maker1. sells stock at the

Q65: During 2009, Bascom Bakery Inc. paid out

Q67: If a stock is quoted 12.79 13.02,