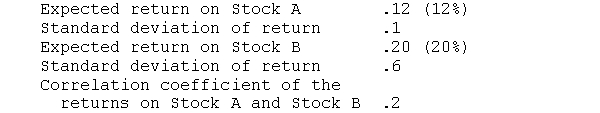

Given the following information:  a. What are the expected returns and standard deviations of the following portfolios:1. 100 percent of funds invested in Stock A 2. 100 percent of funds invested in Stock B 3. 50 percent of funds invested in each stock b. What would be the impact if the correlation coefficient were 0.6 instead of 0.2

a. What are the expected returns and standard deviations of the following portfolios:1. 100 percent of funds invested in Stock A 2. 100 percent of funds invested in Stock B 3. 50 percent of funds invested in each stock b. What would be the impact if the correlation coefficient were 0.6 instead of 0.2

Definitions:

Project Teams

Groups of individuals brought together to work on a specific project, with a defined goal and timeline, often cross-functional and multidisciplinary in nature.

Permanent Nature

The intrinsic and enduring characteristics of something, implying that it remains unchanged over time.

Supplier Strategic Alliances

Partnerships formed between companies and their suppliers to achieve strategic goals, enhance competitiveness, and secure supply chains.

Preferred Supplier-Customer Relationships

Business arrangements where mutual benefits are derived from long-term associations between suppliers and their key customers, often characterized by trust and cooperation.

Q10: An investor expects the price of a

Q23: A 401(k) plan is a<br>A) tax?deferred retirement

Q27: The discount paid for the shares of

Q32: An annuity is a series of<br>A) rising

Q34: Your uncle plans to leave you an

Q43: A direct transfer of funds from savers

Q45: If an investor buys stock on the

Q67: A mutual fund with a beta coefficient

Q79: The more financially leveraged a firm, the

Q105: Lower depreciation increases earnings and cash flow.