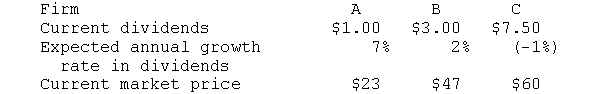

As an investor you have a required rate of return of 14 percent for investments in risky stocks. You have analyzed three risky firms and must decide which (if any) to purchase. Your information is

a. What is your valuation of each stock using the dividend-growth model? Which (if any) should you buy?

b. If you bought Stock A, what is your implied rate of return?

c. If your required rate of return were 10 percent, what should be the price necessary to induce you to buy Stock A?

Definitions:

Intercorrelations

Statistical relationships or associations between two or more variables.

Psychometric

Relating to the science of measuring mental capacities and processes.

Stereotype Threat

The risk of confirming negative stereotypes about one's social group, which can impair performance.

Negative Stereotypes

Oversimplified and generally negative assumptions about a group of people based on their membership in that group.

Q3: Because of arbitrage, an option should not

Q5: Many investments such as stock have commoncharacteristics

Q6: Investing in stocks purchased by insiders may

Q11: Concerning a new issue of stock, a

Q20: The larger the rate of interest, the

Q24: You purchase a three-month discount security (e.g.,

Q25: A bond's seller pays accrued interest to

Q44: A firm may not repurchase bonds at

Q53: The negative relationship between interest rates and

Q88: Which of the following occurs when a