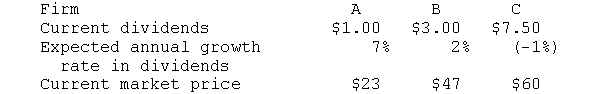

As an investor you have a required rate of return of 14 percent for investments in risky stocks. You have analyzed three risky firms and must decide which (if any) to purchase. Your information is

a. What is your valuation of each stock using the dividend-growth model? Which (if any) should you buy?

b. If you bought Stock A, what is your implied rate of return?

c. If your required rate of return were 10 percent, what should be the price necessary to induce you to buy Stock A?

Definitions:

Letter of Transmittal

A formal document that accompanies a report or document, outlining the content and purpose of the documents being sent.

Water Pollution

The contamination of water bodies (like lakes, rivers, oceans, aquifers) due to harmful substances being discharged into them, affecting aquatic life and human health.

Prompt Action

Taking swift and efficient steps to address a situation or task.

Short Reports

Short reports are concise documents focused on presenting facts, findings, or updates, often used in business, science, and academia for quick information dissemination.

Q11: A call feature is an option while

Q15: If the Federal Reserve lowers the target

Q19: When an investor purchases a bond, that

Q27: According to the Black/Scholes option valuation model,

Q28: If you purchase a $5 preferred stock

Q38: The current ratio is unaffected by<br>A) using

Q44: The strike price of an option is

Q63: Using the income statement and balance sheet

Q83: As the price of a stock rises,

Q87: Dividend policy depends on1. the firm's earnings2.