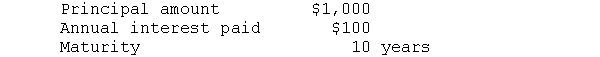

A high-yield bond has the following terms:

a. What is the bond's price if comparable debt yields 12 percent?

b. What would be the price if comparable debt yields 12 percent and the bond matures after five years?

c. What are the current yields and yields to maturity in a and b?

d. What would be the bond's price in a and b if interest rates declined to 9 percent?

e. What are the current yield and yield to maturity in d?

Definitions:

MTBF Distribution

MTBF (Mean Time Between Failures) Distribution is a statistical representation of the expected performance or reliability of a system, indicating the average time between failures.

Standard Deviation

A measure of the dispersion or variation in a set of values, indicating how spread out the values are from the mean.

6-Sigma Standards

A set of quality management techniques and tools aimed at reducing the probability of defects and variability in manufacturing and business processes to improve performance.

Tolerance-Check Process

A quality control procedure that verifies if manufactured parts meet predefined physical dimensions and specifications.

Q1: The gross profit margin on sales tends

Q2: According to the Black/Scholes option valuationmodel, the

Q16: Preferred stock generally pays<br>A) a variable dividend<br>B)

Q18: The party promising to pay a note

Q28: If you purchase a $5 preferred stock

Q41: The amount of margin required to enter

Q44: Convertible bonds tend to sell for a

Q93: If inventory is sold for cash, inventory

Q112: Lowery Co. uses the direct write-off method

Q139: The allowance method of estimating uncollectible accounts