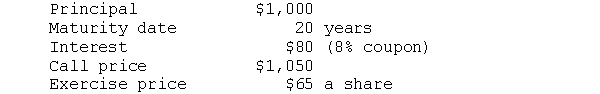

Given the information below, answer the following questions.A convertible bond has the following features:

a. The bond may be converted into how many shares?

b. If comparable non-convertible debt offered an annual yield of 12 percent, what would be the value of this bond as debt?

c. If the stock were selling for $52, what is the value of the bond in terms of stock?

d. Would you expect the bond to sell for its value as debt (i.e., the value determined in b) if the price of the stock were $52?

e. If the price of the bond were $960, what are the premiums paid over the bond's value as stock and its value as debt?

Definitions:

Intelligence Quotient

A measure of a person's cognitive abilities in relation to their age group, often abbreviated as IQ.

Alfred Binet

A French psychologist who, along with Theodore Simon, developed the first intelligence test, laying the foundation for modern intelligence theory and testing.

School Performance

A measure of how well students achieve or accomplish educational goals and tasks.

Test-Retest Procedures

A method of assessing the reliability of a test by administering the same test to the same subjects at two different points in time and comparing the scores.

Q3: If foreign securities markets are as efficient

Q5: Under current law, American corporations may notissue

Q6: Convertible bonds tend to pay more interest

Q23: A mutual fund's net asset value is

Q29: In preparing a bank reconciliation, the amount

Q43: A convertible bond's payback period1. increases as

Q77: A check for $342 was erroneously charged

Q119: Journalize the following transactions in the accounts

Q129: In preparing a bank reconciliation, the amount

Q171: The term "receivables" includes all<br>A) money claims