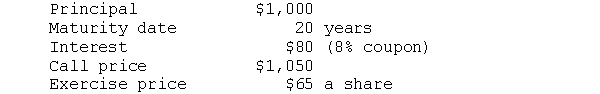

Given the information below, answer the following questions.A convertible bond has the following features:

a. The bond may be converted into how many shares?

b. If comparable non-convertible debt offered an annual yield of 12 percent, what would be the value of this bond as debt?

c. If the stock were selling for $52, what is the value of the bond in terms of stock?

d. Would you expect the bond to sell for its value as debt (i.e., the value determined in b) if the price of the stock were $52?

e. If the price of the bond were $960, what are the premiums paid over the bond's value as stock and its value as debt?

Definitions:

Basic Research

Research conducted to increase fundamental knowledge and understanding, without specific immediate commercial applications.

Percentage

A portion or division of a whole expressed as a number out of 100.

Development

Development refers to the process of economic growth, structural change, and improvement in the living standards and quality of life of a population.

Q6: The balance in Allowance for Doubtful Accounts

Q10: Realized returns should include both dividends and

Q14: Investing in futures contracts is considered to

Q28: Monetary policy affects securities prices by1. affecting

Q34: An analysis of last year's financial statements

Q35: A stock's price will tend to fall

Q47: The current yield and the yield to

Q69: Ratios may be used in both time

Q129: In preparing a bank reconciliation, the amount

Q191: Under the direct write-off method of accounting