Listed below are selected transactions completed by Ridge Company during March of the current year.Mar.

5 Rendered services on account to Quinton Co., Invoice No. 92, $3,250.

10 Rendered services on account to Martin Inc., Invoice No. 93, $4,500.

13 Received $5,000 in payment of monthly rent, which was due on March 1.

15 Received payment from Quinton Co. for invoice of March 5.

19Received payment from Martin Inc. for balance due on invoice of March 10.

20 Received amount due from Thomas Co. on sale made in February, $5,200.

31 Recorded cash from services rendered for cash during the month, $15,750.?

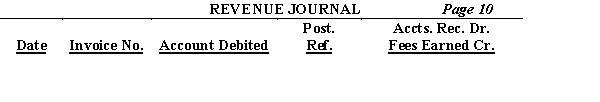

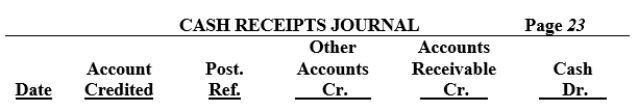

(a)Record the transactions in the revenue journal and cash receipts journal.

(b)Total and rule the revenue and cash receipts journals.

(c)Indicate the method of posting the individual items and the columnar totals of the revenue and cash receipts journals in the following manner:

(1)For individual items and totals to be posted to the subsidiary ledger or not to be posted, insert a check mark in the Post. Ref. column or below the totals.

(2)For individual items and totals to be posted to the general ledger, insert the letter "G"

(as a substitute for specific account numbers) in the Post. Ref. column or below the totals.??

Definitions:

Bonds Mature

The point in time when a bond's principal amount is due to be paid back to the bondholder.

Interest Payments

Payments made to a lender by a borrower in return for the use of borrowed money, typically represented as an annual percentage of the loan principal.

Unrealized Gain

An increase in the value of an asset that has not been sold yet; hence, the gain is not reflected in the income statement.

Stock Investment

The purchase of shares in a company with the expectation of earning a return in the form of dividends or capital gains.

Q44: Revenues are equal to the difference between

Q46: An end-of-period spreadsheet includes columns for<br>A) adjusting

Q64: Debits will increase unearned revenues and revenues.

Q86: Liabilities that will be due within one

Q105: Calculate the gross profit for Jonas

Q127: This system can be costly and time

Q140: A cash investment made by the owner

Q176: Sales is equal to the cost of

Q192: Accounts receivable subsidiary ledger/Accounts Receivable Dr.<br>a. Purchases

Q218: Complete the following data taken from