Analyze the following transactions as to their effect on the accounting equation.

(a)The company paid $725 to a vendor for supplies purchased previously on account.

(b)The company performed $850 of services and billed the customer.

(c)The company received a utility bill for $395 and will pay it next month.

(d)The owner of the company withdrew $145 of supplies for personal use.

(e)The company paid $315 in salaries to its employees.

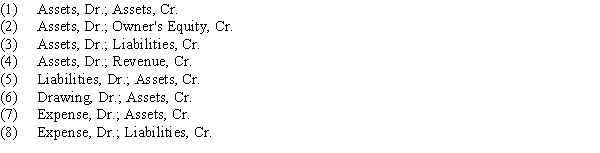

(f)The company collected $730 of cash from its customers on account.Some of the possible effects of a transaction on the accounting equation are listed below  Put the appropriate letter next to each transaction.

Put the appropriate letter next to each transaction.

Definitions:

U.S. GAAP

The accounting standards and principles specifically used within the United States to guide the preparation of financial statements.

Currency Balances

Refers to the amounts of foreign currencies held by a company at any given time, which can fluctuate due to changes in exchange rates.

IFRS Statements

International Financial Reporting Standards (IFRS) Statements are financial statements prepared following the IFRS guidelines, aimed at ensuring transparency, accountability, and comparability across the global financial environment.

Previous GAAP

The Generally Accepted Accounting Principles that were in place before the current set or version was adopted.

Q13: What effect will the following adjusting

Q16: Record journal entries for the following transactions.<br>(a)

Q31: Listed below are accounts to use

Q42: For Years 1-5, a proposed expenditure of

Q116: What is the activity rate for materials

Q146: What effect will this adjustment have

Q153: The accounts payable account is listed in

Q159: Transfer prices may be used when decentralized

Q204: An overpayment error was discovered in computing

Q226: Office supplies purchased by Janer's Cleaning Service