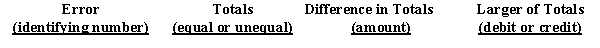

Answer the following questions for each of the errors listed below, considered individually:

(a)Did the error cause the trial balance totals to be unequal?

(b)What is the amount of the difference between the trial balance totals

(where applicable)?

(c)Which of the trial balance totals, debit or credit, is the larger

(where applicable)?Present your answers in columnar form, using the following headings:Errors:  (1)A withdrawal of $3,000 cash by the owner was recorded by a debit of $3,000 to Salary Expense and a credit of $3,000 to Cash.

(1)A withdrawal of $3,000 cash by the owner was recorded by a debit of $3,000 to Salary Expense and a credit of $3,000 to Cash.

(2)A $650 purchase of supplies on account was recorded as a debit of $1,650 to Equipment and a credit of $1,650 to Accounts Payable.

(3)A purchase of equipment for $3,450 on account was not recorded.

(4)An $870 receipt on account was recorded as an $870 debit to Cash and a $780 credit to Accounts Receivable.

(5)A payment of $1,530 cash on account was recorded only as a credit to Cash.

(6)Cash sales of $8,500 were recorded as a credit of $8,500 to Cash and a credit of $8,500 to Fees Earned.

(7)The debit to record a $4,000 cash receipt on account was posted twice; the credit was posted once.

(8)The credit to record a $300 cash payment on account was posted twice; the debit was posted once.

(9)The debit balance of $7,400 in Accounts Receivable was recorded in the trial balance as a debit of $7,200.

Definitions:

Openness

A personality trait that involves the appreciation for new experiences, creativity, and a willingness to explore novel ideas.

Stable Personality

A personality type characterized by enduring, consistent behaviors and relatively predictable reactions across different situations.

Dramatic Changes

Significant and often sudden alterations in situation or condition, typically implying a major shift in perspective or outcome.

Personalities

The combination of characteristics or qualities that form an individual's distinctive character.

Q35: What is the service department charge rate

Q45: Snipe Company has been purchasing a component,

Q103: The chart of accounts should be the

Q110: On the basis of the following information

Q130: Using the variable cost concept, determine the

Q136: A fixed asset's market value is reflected

Q153: Prepaid advertising, representing payment for the next

Q155: A trial balance is prepared to<br>A) prove

Q178: Using the tables above, what would be

Q180: Depreciation on equipment was not recorded.<br>A)Assets and