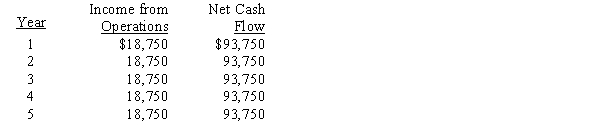

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The cash payback period for this investment is

Definitions:

Q9: Cost-plus methods determine the normal selling price

Q52: Bloom's Company pays biweekly salaries of

Q71: What is the amount of income or

Q86: Which of the following is not a

Q92: Using accrual accounting, expenses are recorded and

Q101: Operating expenses directly traceable to or incurred

Q110: Supplies are recorded as assets when purchased.

Q116: Journalizing a transaction with both the debit

Q175: The underlying principle of allocating direct operating

Q189: Services provided to customers on the last