A project has estimated annual cash flows of $95,000 for four years and is estimated to cost $260,000. Assume a minimum acceptable rate of return of 10%. Using the following tables determine the

(a) net present value of the project and

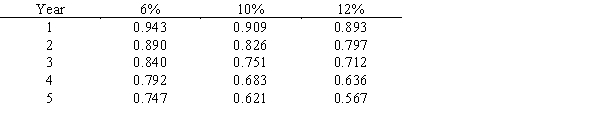

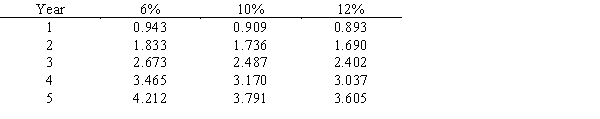

(b) the present value index, rounded to two decimal places.Below is a table for the present value of $1 at compound interest.  Below is a table for the present value of an annuity of $1 at compound interest.

Below is a table for the present value of an annuity of $1 at compound interest.

Definitions:

Corporate Equity

Represents the ownership interest held by shareholders in a corporation, measured as the company's total assets minus its total liabilities.

Asset Allocation

The strategy of distributing investments among different asset categories, such as stocks, bonds, and cash, to optimize risk and return.

Investment Portfolio

A collection of various types of investments held by an individual, institutional investor, or financial institution aiming to diversify risk and achieve certain financial goals.

Asset Classes

Categories of assets, such as stocks, bonds, real estate, and commodities, that exhibit similar characteristics and behave similarly in the marketplace.

Q81: Investment turnover (as used in determining

Q82: Using the tables above, what would be

Q108: The process of recording a transaction in

Q123: A favorable cost variance occurs when<br>A) actual

Q124: What is the return on investment for

Q136: Normal account balances are on the increase

Q160: If the profit margin for a division

Q169: Owner's equity will be reduced by all

Q173: Which of the following describes the classification

Q196: Which of the following entries records the