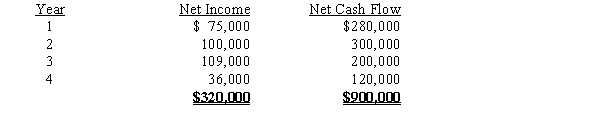

Dickerson Co. is evaluating a project requiring a capital expenditure of $810,000. The project has an estimated life of four years and no salvage value. The estimated net income and net cash flow from the project are as follows:?  The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for Years 1 through 4 is 0.893, 0.797, 0.712, and 0.636, respectively.Determine the net present value.

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for Years 1 through 4 is 0.893, 0.797, 0.712, and 0.636, respectively.Determine the net present value.

Definitions:

Q12: When a transposition error is made on

Q38: The standard cost is how much a

Q40: How much will Division 6's income from

Q41: On September 1, Erika Company purchased land

Q74: On January 1, Merry Walker established

Q99: A project is estimated to cost $248,400

Q102: The production department is proposing the purchase

Q197: Explain the difference between the accrual basis

Q204: Allocated equally among divisions<br>A)Purchasing<br>B)Payroll Accounting<br>C)Human Resources<br>D)Maintenance<br>E)Information Systems<br>F)Marketing<br>G)President's

Q216: Joshua Scott invests $40,000 into his new