Project A requires an original investment of $65,000. The project will yield cash flows of $15,000 per year for seven years. Project B has a calculated net present value of $5,500 over a five-year life. Project A could be sold at the end of five years for a price of $30,000.

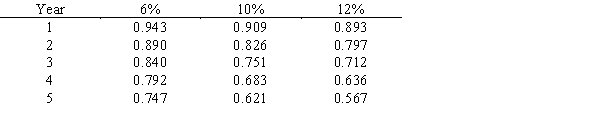

(a) Using the table below, determine the net present value of Project A over a five-year life with salvage value assuming a minimum rate of return of 12%.

(b) Which project provides the greatest net present value?Below is a table for the present value of $1 at compound interest.?  Below is a table for the present value of an annuity of $1 at compound interest.

Below is a table for the present value of an annuity of $1 at compound interest.

Definitions:

Government Procurement Contract

An agreement between the government and a private company for the provision of goods and services to the government.

Adequate Funding

Sufficient financial resources allocated to support a project, initiative, or organization.

Shopping Portal

An online platform that aggregates a wide variety of products from different suppliers, allowing consumers to compare and purchase items in one place.

Favorable Tax Treatment

Tax policies or regulations that provide benefits or reductions in tax liabilities for certain activities or investments.

Q11: Proposals A and B each cost $600,000

Q26: The DuPont formula uses financial and nonfinancial

Q84: In the chart of accounts, the balance

Q94: Standard costs are determined by multiplying expected

Q97: A contract to provide tutoring services beginning

Q112: To calculate income from operations, total service

Q132: Which of the following errors will cause

Q145: Uses present value concepts to compute the

Q169: Differential analysis only considers the short-term <br>(one-year)

Q194: Journalizing is the process of entering amounts