Use this information for ABC Corporation to answer the questions that follow.

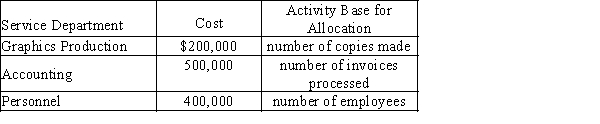

ABC Corporation has three service departments with the following costs and activity base:

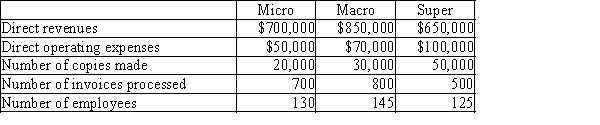

ABC has three operating divisions, Micro, Macro and Super. Their revenue, cost and activity information is as follows:

ABC has three operating divisions, Micro, Macro and Super. Their revenue, cost and activity information is as follows:

-What will the income of the Super Division be after all service department allocations?

Definitions:

Balance Sheet Amounts

The monetary values assigned to assets, liabilities, and equity in the balance sheet at a specific point in time, reflecting a company’s financial position.

Paid-in Capital

The amount of capital "paid in" by investors during common or preferred stock issuances, including the par value of the shares and any amount paid in excess.

Organization Expenses

Expenses associated with the formation of a corporation or organization, such as legal fees, registration fees, and promotional expenses.

Par Value

A nominal value assigned to a security, such as a stock, which is stated in the corporate charter and often bears no relation to its market value.

Q3: A company is contemplating investing in a

Q28: The relative distribution of sales among the

Q30: The budget for Department 6 of Cardinal

Q112: Johnson Plumbing's fixed costs are $700,000 and

Q112: To calculate income from operations, total service

Q112: A commercial oven with a book value

Q140: Hadley Company is considering the disposal of

Q148: For higher levels of management, responsibility accounting

Q161: Use the data below for Coffee &

Q162: Hsu Company produces a part with a