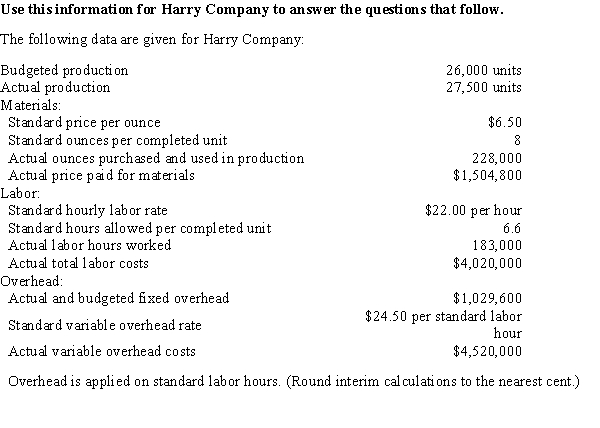

-Calculate the direct materials quantity variance.

Definitions:

Variable Distribution Costs

Expenses related to the delivery or distribution of a product that vary in proportion to the volume of units sold.

Contribution Margin

The amount remaining from sales revenue after variable production costs and variable expenses have been deducted; used to cover fixed costs and to generate profit.

Traceable Fixed Expenses

Fixed costs that can be directly linked to a specific business segment, product, or operation and would disappear if the segment was discontinued.

Common Fixed Expenses

Fixed costs that are not directly attributable to a specific product or service line and must be paid regardless of the level of production or sales.

Q4: Differential revenue is the amount of increase

Q7: If the standard to produce a given

Q109: If the standard to produce a given

Q111: Income from operations of the Pierce Automobile

Q120: The principle of exceptions allows managers to

Q123: A favorable cost variance occurs when<br>A) actual

Q141: What is the differential revenue of producing

Q148: Louis Company sells a single product at

Q192: The Central Division of Nebraska Company has

Q210: Given the following cost data, what type