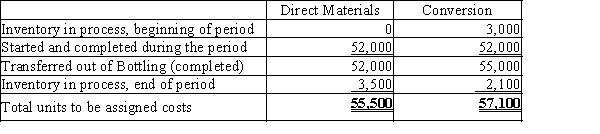

The cost per equivalent unit of direct materials and conversion in the Bottling Department of Beverages on Jolt Company is $0.47 and $0.15, respectively. The equivalent units to be assigned costs are as follows:?  The beginning work in process inventory had a cost of $3,500. Determine the cost of completed and transferred out production and the ending work in process inventory.

The beginning work in process inventory had a cost of $3,500. Determine the cost of completed and transferred out production and the ending work in process inventory.

Definitions:

Prime Costs

The direct costs directly attributable to the production of goods, including direct materials and direct labor.

Conversion Costs

The total expenses of direct labor plus manufacturing overheads spent in transforming raw materials into completed goods.

Depreciation Expense

Depreciation expense represents the allocated cost of an asset's reduction in value over time, reflecting the wear and tear or obsolescence of long-term assets used in business operations.

Nonmanufacturing Cost

Expenses not directly related to the production of goods, such as selling, general, and administrative expenses.

Q6: Recording jobs completed would include a credit

Q49: The following is a list of various

Q61: The manufacturing cost of Carrie Industries for

Q62: Conversion costs<br>A)Direct labor and factory overhead<br>B)Direct labor

Q67: A tax preparation firm<br>A)Service business<br>B)Manufacturing business<br>C)Merchandising business

Q85: A difference in quantity of materials used

Q112: Johnson Plumbing's fixed costs are $700,000 and

Q134: As product costs are incurred in the

Q159: Assume that Corn Co. sold 8,000 units

Q165: The primary financial statements of a proprietorship