Schultz Tax Services, a tax preparation business, had the following transactions during the month of June:

1. Received cash for providing accounting services, $3,000.

2. Billed customers on account for providing services, $7,000.

3. Paid advertising expense, $800.

4. Received cash from customers on account, $3,800.

5. Owner made a withdrawal, $1,500.

6. Received telephone bill, $220.

7. Paid telephone bill, $220.

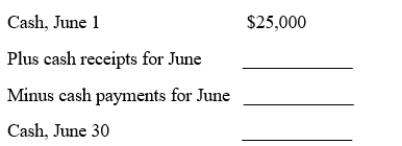

Based on the information given above, calculate the balance of cash at June 30. Use the following reconciliation.

Definitions:

Motivating Employees

The process of encouraging employees to perform their best by fulfilling their needs, enhancing their job satisfaction, and achieving organizational goals.

Learned Competencies

Skills and knowledge acquired through education, training, and experience that enhance an individual's ability to perform tasks effectively.

Natural Talent

Natural talent is an inherent ability or aptitude in a particular area, allowing someone to excel with seemingly effortless skill.

Goal-related Tasks

Activities or assignments that are directly aligned with achieving specific objectives or outcomes.

Q18: Cavy Company estimates that total factory overhead

Q36: Which of the following would record the

Q42: A business paid $7,000 to a creditor

Q86: In a process costing system, the cost

Q87: A manufacturing business reports just two types

Q94: If the cost of a direct material

Q113: Prepare a balance sheet for Thompson Computer

Q120: Baker's wages<br>A)Product costs<br>B)Period costs

Q185: Period costs are classified as either<br>A) selling

Q227: A formal presentation of the accounting equation<br>A)Income