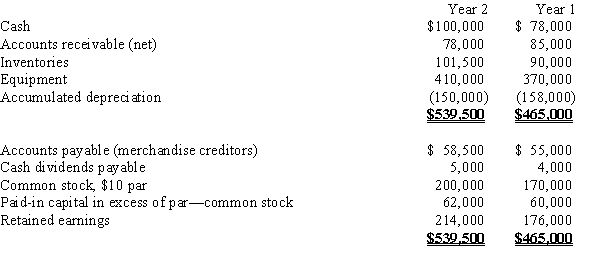

On the basis of the following data for Larson Co. for the year ending December 31 Year 2, and the preceding year ended December 31, Year 1, prepare a statement of cash flows. Use the indirect method of reporting cash flows from operating activities. In addition to the balance sheet data, assume that:Equipment costing $125,000 was purchased for cash.Equipment costing $85,000 with accumulated depreciation of $65,000 was sold for $15,000.The stock was issued for cash.The only entries in the retained earnings account were net income of $51,000 and cash dividends declared of $13,000.

Definitions:

Single-Index Model

A simplified way to estimate the return of a stock using the performance of a single market index as the primary factor.

Macro Risk

The potential for financial loss in markets that arises from adverse changes in macroeconomic conditions.

Micro Risk

A type of risk that affects a very small segment of the market or an individual company, as opposed to the entire economy or financial system.

Unanticipated Events

Occurrences or outcomes that were not expected or predicted, often causing significant impact on plans or expectations.

Q10: When the effective interest rate method of

Q12: Which of the following is the appropriate

Q31: Callable bonds can be redeemed by the

Q40: A company with 100,000 authorized shares of

Q41: The following information was taken from

Q43: The net income reported on the

Q82: Discuss the similarities and differences in reporting

Q121: Most companies invest excess cash in bonds

Q153: Which of the following should be shown

Q163: A business issues 20-year bonds payable in