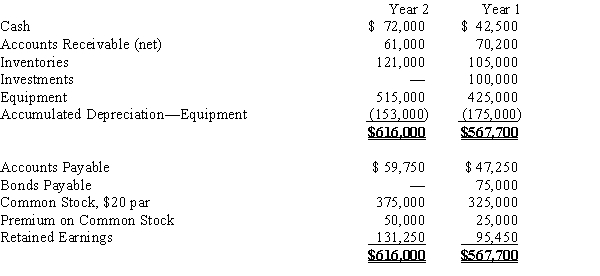

The comparative balance sheets of Barry Company, for Years 1 and 2 ended December 31, appear below in condensed form.  Additional data for the current year are as follows:

Additional data for the current year are as follows:

(a)Net income, $75,800.

(b)Depreciation reported on income statement, $38,000.

(c)Fully depreciated equipment costing $60,000 was scrapped, no salvage, and equipment was purchased for $150,000.

(d)Bonds payable for $75,000 were retired by payment at their face amount.

(e)2,500 shares of common stock were issued at $30 for cash.

(f)Cash dividends declared and paid, $40,000.

(g)Investments of $100,000 were sold for $125,000.Prepare a statement of cash flows using the indirect method.

Definitions:

Defined-contribution Plans

A type of retirement plan where an employer, employee, or both make contributions on a regular basis, but future benefits depend on the investment's performance.

Employee Compensation

The total amount of monetary and non-monetary pay provided to an employee by an employer in return for work performed.

Nature of Benefits

The inherent advantages or positive outcomes that come from certain actions, policies, or products.

Family-friendly Benefits

Workplace policies that accommodate employees' needs for child care, parental leave, and other family-related matters.

Q9: Nebraska Inc. issues 3,000 shares of common

Q10: Land costing $140,000 was sold for $173,000

Q35: The company investing in another company's stock<br>A)Debt

Q81: Dorman Company reported the following data: <img

Q120: Using the following table, what is the

Q120: To record a bond investment made between

Q131: Indirect materials used<br>A)Direct materials<br>B)Selling and administrative expense<br>C)Factory

Q148: On May 1, Cedar Inc. purchases $100,000

Q160: All of the following are true of

Q241: Sales supplies used<br>A)Direct materials<br>B)Selling and administrative expense<br>C)Factory