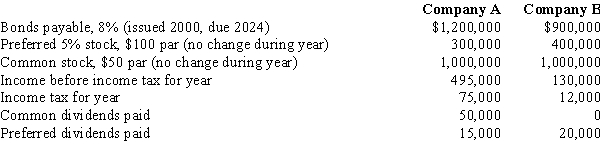

Balance sheet and income statement data indicate the following:  (a)For each company, what is the times interest earned ratio

(a)For each company, what is the times interest earned ratio

(round to one decimal place)?

(b)Which company gives potential creditors the most protection?

Definitions:

Personal Exemptions

Deductions allowed by the IRS on income tax for the taxpayer and dependents, though largely eliminated for tax years 2018 through 2025.

Amount

A quantitative measure or sum of money.

Exemption

A deduction allowed by law to reduce the amount of income that would otherwise be taxed. These are often provided for the taxpayer, their spouse, and dependents.

Full-Time Student

An individual enrolled in a higher education institution for the number of hours or courses the school considers to be full-time attendance.

Q14: Long-term investments are held for all of

Q33: A disadvantage of the corporate form of

Q43: When a partnership is formed, assets contributed

Q81: Tucker and Titus are partners who share

Q90: The times interest earned ratio is computed

Q92: The manner of reporting cash flows from

Q136: The two main sources of stockholders' equity

Q173: The capital accounts of Heidi and Moss

Q187: When a new partner purchases the entire

Q187: On March 4 of the current year,