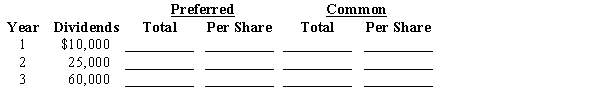

A company had stock outstanding as follows during each of its first three years of operations: 2,500 shares of 10%, $100 par, cumulative preferred stock and 50,000 shares of $10 par common stock. The amounts distributed as dividends are presented below. Determine the total and per-share dividends for each class of stock for each year by completing the schedule.

Definitions:

Operating Expenses

Costs that are related to the day-to-day operations of a business, such as rent, utilities, and payroll, excluding cost of goods sold.

Capital Budgeting

The act of strategizing and overseeing a corporation's extensive investments in ventures and assets over an extended period.

Straight-Line Depreciation

A technique for distributing the cost of a physical asset across its lifespan in uniform yearly payments.

Capital Budgeting

The process of making long-term planning decisions for investments in projects and assets, assessing their potential financial benefits.

Q6: The final step in the liquidation of

Q10: Townson Company had gross wages of

Q64: Journalize the following selected transactions completed during

Q67: Paid-in capital may originate from real estate

Q90: Employers are required to compute and report

Q109: A corporation often issues callable bonds to

Q114: Soledad and Winston are partners who share

Q178: As part of the initial investment, Jackson

Q178: Owners of this class of stock are

Q217: Equity account reflecting shares "owed" to stockholders<br>A)Cash