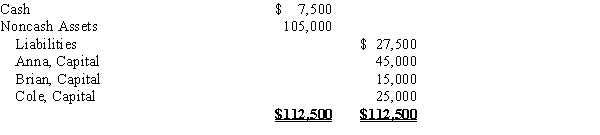

After discontinuing the ordinary business operations and closing the accounts on May 7, the ledger of the partnership of Anna, Brian, and Cole indicated the following:  The partners share net income and losses in the ratio of 3:2:1. Between May 7 and May 30, the noncash assets were sold for $150,000, the liabilities were paid, and the remaining cash was distributed to the partners.

The partners share net income and losses in the ratio of 3:2:1. Between May 7 and May 30, the noncash assets were sold for $150,000, the liabilities were paid, and the remaining cash was distributed to the partners.

(a)Prepare a statement of partnership liquidation.

(b)Assume the same facts as in

(a), except that the noncash assets were sold for $45,000 and any partner with a capital deficiency pays the amount of the deficiency to the partnership. Prepare a statement of partnership liquidation.

Definitions:

Reexperiencing Trauma

The involuntary and distressing reliving of past traumatic events, often a symptom of post-traumatic stress disorder (PTSD).

Hypervigilance

An increased awareness of sensory inputs paired with an intensified range of actions aimed at identifying potential dangers.

Emotional Numbness

A condition characterized by a lack of emotional response or feeling, often as a result of trauma or stress.

Adjustment Disorder

A psychological response to an identifiable stressor or group of stressors that causes significant emotional or behavioral symptoms.

Q20: A method of selecting a sample by

Q27: Shares of common stock that were issued

Q32: A fixed asset with a cost of

Q68: A new kitchen gadget that can be

Q81: Journalize the following selected transactions completed during

Q115: After all noncash assets have been converted

Q139: A company with 100,000 authorized shares of

Q169: A corporation, which had 18,000 shares of

Q176: Golden Sales has bought $135,000 in fixed

Q207: When a corporation completes a 3-for-1 stock