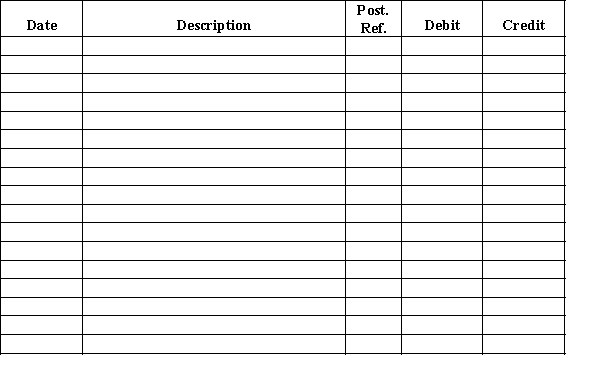

Equipment acquired at a cost of $126,000 has a book value of $42,000. Journalize the disposal of the equipment under the following independent assumptions.

(a)The equipment had no market value and was discarded.

(b)The equipment is sold for $54,000.

(c)The equipment is sold for $24,000.

(d)The equipment is traded in for a similar asset. The list price of the new equipment is $63,000. The buyer gave no cash in the exchange. The transaction lacks commercial substance.Journal

Definitions:

Kneeling Statue

A type of sculpture depicting an individual in a kneeling position, often used in religious or ceremonial contexts to denote humility, devotion, or supplication.

Hatshepsut

An 18th dynasty Pharaoh of Egypt who reigned during the early 15th century BC, one of the few female monarchs in ancient Egyptian history.

Royal Headdress

An ornate and often symbolic form of headgear worn by members of royalty as a sign of sovereignty and dignity.

Temple Complex

An area composed of one or more temples along with associated buildings, usually dedicated to a particular group of gods or a religious practice.

Q4: The amount of the depreciation expense for

Q7: The _ leaving the decision node correspond

Q8: A nonparametric method for determining the differences

Q33: In quality control terminology, the statistical procedure

Q36: A regression model involving 4 independent variables

Q45: The payroll register is a multicolumn form

Q57: In a sample of 120 people, 50

Q86: In simple linear regression, r<sup>2</sup> is the<br>A)

Q105: When a company exchanges machinery and receives

Q156: Loss on Disposal of Asset<br>A)Current assets<br>B)Fixed assets<br>C)Intangible